dxjdh99.site Tools

Tools

Who Is The Best For Personal Loans

Compare personal loan rates and loan companies to determine the lender that's right for you. The best place to take out a personal loan is from the lender that offers you the lowest interest rate and fewest fees, and makes it easy to complete an. Top picks from our partners · Best for Large Amounts: SoFi · Best for Debt Consolidation: Happy Money · Best for Small Amounts: Upgrade. Upgrade logo. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! A personal loan is a great way to consolidate debt, finance home improvements and more. TTCU's personal loans, like a share secured loan. Find personal loans with low monthly payments through Engine by MoneyLion, a loan search engine and Earnest partner. Enter your details, get your rates. Check personal loan rates for free in 2 minutes without affecting your credit score. Loan amounts from $ to $ No hidden fees. Personal loans from Wells Fargo are a great way to manage debt, fund special purchases, or cover major expenses. Apply online. Looking for the best personal loan to achieve your financial goals? See which lender tops our list this month and offers the best terms and fees. Compare personal loan rates and loan companies to determine the lender that's right for you. The best place to take out a personal loan is from the lender that offers you the lowest interest rate and fewest fees, and makes it easy to complete an. Top picks from our partners · Best for Large Amounts: SoFi · Best for Debt Consolidation: Happy Money · Best for Small Amounts: Upgrade. Upgrade logo. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! A personal loan is a great way to consolidate debt, finance home improvements and more. TTCU's personal loans, like a share secured loan. Find personal loans with low monthly payments through Engine by MoneyLion, a loan search engine and Earnest partner. Enter your details, get your rates. Check personal loan rates for free in 2 minutes without affecting your credit score. Loan amounts from $ to $ No hidden fees. Personal loans from Wells Fargo are a great way to manage debt, fund special purchases, or cover major expenses. Apply online. Looking for the best personal loan to achieve your financial goals? See which lender tops our list this month and offers the best terms and fees.

Explore the Flexibility of TD Fit Loan. Watch this quick video to learn more about why a TD Fit Loan might be the right fit for you! Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Our quick, easy personal loan process could get you the money you need to get out of a pinch or make a dream real. Centris FCU offers secured & unsecured personal loans with competitive interest rates. Visit today to learn more best personal loan option for your needs. Why. We researched and evaluated APRs, fees, loan amounts, terms, customer experience, and more from 70 leading personal loan lenders. Our top pick is SoFi. Best Personal Loan for Home Improvement. NerdWallet – · Best Overall Auto Lender. Bankrate – · Best Low Interest Personal Loan. The Motley Fool Ascent –. personal assets, so you can choose the type of loan that best fits your financial needs. When applying for an unsecured personal loan, we look at factors. Explore Additional Personal Loans Lenders · SoFi Personal Loans Review · LightStream Personal Loans Review · PenFed Credit Union · Prosper Personal Loans Review. Hawaii State FCU offers personal loans with flexible credit limits, low rates, and easy repayment options suitable for your needs. Apply online today! Unsecured personal loan · $3, minimum loan amount · Rates range from % to % APR Excellent credit required for lowest rate · No origination fees. We rounded up our picks for top six personal loan lenders offering some of the best APRs and no (or low) origination fees. The best personal loan company overall is LightStream, as this online personal loan provider offers an excellent combination of low interest rates, $0 fees, and. Best for home improvement: LightStream. Why LightStream stands out: LightStream — the online lending division of Truist Bank — offers personal loans ranging. Unsecured personal loan · $3, minimum loan amount · Rates range from % to % APR Excellent credit required for lowest rate · No origination fees. With a Wells Fargo personal loan you'll get access to competitive fixed rate loans with flexible terms. Start the online application process today! A personal loan is a great financial tool. It can help you consolidate debt, renovate your home, or even pay for college. Through the personal loan program at Axos Bank, you can borrow money fast with great rates, flexible terms, fixed monthly payments, and no collateral. From consolidating debt to funding a major purchase, an unsecured personal loan from U.S. Bank might be just what you need. Apply online now! See why Discover's a great choice · Citibank Personal Loan · LendingClub · SoFi · Wells Fargo Personal Loans · Prosper Funding · Upstart. With a Wells Fargo personal loan you'll get access to competitive fixed rate loans with flexible terms. Start the online application process today!

Stock Market Sites For Beginners

How to trade stocks · 1. Pick a brokerage account · 2. Research investment options · 3. Create a trading plan and exit strategy. Here are the best investment firms and trading websites where you can open brokerage accounts to buy and sell stocks online. Our picks include Fidelity. Build your portfolio starting with just $1. Invest in stocks, options, and ETFs at your pace and commission-free. Advice · For beginner investing · For personal finances · For family finances; checkmark Stash+ Market Insights ; Investing access · Invest in stocks and ETFs. The best online stock brokers for beginners: · Charles Schwab · Fidelity Investments · Interactive Brokers · Ally Invest · E-Trade Financial · Firstrade · Firstrade. Fidelity has added many new options-trading tools and education materials recently. And Merrill Edge continues to bolster its user-friendly Idea Builder and. fxtm is a great online trading platform for beginners. It has low trading fees, advanced tools, and resources to help new traders learn the. What you'll learn · Understand how the stock market works and its main purpose · Understand the purpose of the main market indices like DowJones30, S&P · Be. Looking to get into day trading with some long-term trading. I know that TD A/Schwab, Fidelity, Vanguard, Interactive Brokers are some of. How to trade stocks · 1. Pick a brokerage account · 2. Research investment options · 3. Create a trading plan and exit strategy. Here are the best investment firms and trading websites where you can open brokerage accounts to buy and sell stocks online. Our picks include Fidelity. Build your portfolio starting with just $1. Invest in stocks, options, and ETFs at your pace and commission-free. Advice · For beginner investing · For personal finances · For family finances; checkmark Stash+ Market Insights ; Investing access · Invest in stocks and ETFs. The best online stock brokers for beginners: · Charles Schwab · Fidelity Investments · Interactive Brokers · Ally Invest · E-Trade Financial · Firstrade · Firstrade. Fidelity has added many new options-trading tools and education materials recently. And Merrill Edge continues to bolster its user-friendly Idea Builder and. fxtm is a great online trading platform for beginners. It has low trading fees, advanced tools, and resources to help new traders learn the. What you'll learn · Understand how the stock market works and its main purpose · Understand the purpose of the main market indices like DowJones30, S&P · Be. Looking to get into day trading with some long-term trading. I know that TD A/Schwab, Fidelity, Vanguard, Interactive Brokers are some of.

We offer a free stock market game featuring real-time stock prices and rankings that allows users to learn about the stock markets and practice investing. Beginners Investment course is the perfect way to learn stock market investing for beginners. Our investing investment courses help you start investing. A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. Platforms & Tools, Investment Options, Mobile Trading Apps, Education, Bank Brokerage, Beginners, Futures Trading, IRA Accounts, Options Trading, Penny. Here are four brokers or trading platforms that are worth considering for beginners in the US: eToro, Why Did We Pick It? is renowned for its user-friendly. Robinhood is a popular app for beginners, known for its commission-free trading and simple interface. It's particularly popular for stocks and cryptocurrencies. Test your skills over a simulated 5-year period, managing stocks, bonds, and mutual funds. Stay informed with market news impacting returns. Engage at beginner. Financial Markets · Yale University ; Practical Guide to Trading · Interactive Brokers ; Trading Basics · Indian School of Business ; Stocks and Bonds · University of. Our proprietary trading platform, dxjdh99.site, is the best way for teens to learn the basics of stock market investing in a risk-free environment. Many commission-free brokers offer trading accounts with no account minimums that allow investors to trade fractional shares of stocks. You can start investing. Learn about the stock market · Understand many of the complexities of the markets · Have confidence to begin investing virtual money · Know how to talk about it. Learn to Invest in the Stock Market with our FREE Courses · Learn the Stock Market Basics · Practice Trading · Master Our Finance and Investment Courses · Our Best-. Everyone has to start somewhere. That old maxim certainly applies to investing or trading in stocks. Do you consider yourself a stock market newcomer? Here's. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Join the millions of people using the dxjdh99.site app every day to stay on top of the stock market and global financial markets! Now a part of the zero commission trading club, they won't charge you fees for buying and selling stocks and ETFs! INTERACTIVE BROKERS. stock market for. SeekingAlpha focuses on providing high-quality articles and resources so that users can get up-to-date information about the stock market. Many people. dxjdh99.site: A Beginner's Guide to the Stock Market: Everything You Need to Start Making Money Today (Audible Audio Edition): Matthew R. Kratter. Your first trade: how to do it · Open and fund your live account · After careful analysis of the market, select your opportunity · 'Buy' if you think that market's. The process of stock trading for beginners · 1. Open a demat account · 2. Understand stock quotes · 3. Bids and asks · 4. Fundamental and technical knowledge of.

Market Price Of Oil

The current month is updated on an hourly basis with today's latest value. The current price of WTI crude oil as of August 28, is $ per barrel. Oil - US Crude chart This market's chart. This is a visual representation of the price action in the market, over a certain period of time. You can use this to. Crude Oil WTI (NYM $/bbl) Front Month ; Day Range - ; 52 Week Range - ; Open Interest , ; 5 Day. % ; 1 Month. %. OPEC Oil Reserves · Historical Production Data · Home Data / Graphs OPEC Basket As of January The basket price includes the Angolan crude "Girassol". Discount home heating oil prices. Plymouth & Cape Cod's discount oil delivery company. Family owned. Weekend & same day delivery. 50 Gallon Deliveries. Like most commodities, the fundamental driver of oil's price is supply and demand in the market. The cost of extracting and producing oil is also an important. Oil Price Charts ; WTI Crude, , + ; Brent Crude, , + ; Murban Crude, , + ; Natural Gas, , ; Gasoline, , + Crude Oil and Commodity Prices ; Natural Gas, , % ; Gasoline, , +% ; Heating Oil, , +% ; Gold, , +%. Oil Price: Get all information on the Price of Oil including News, Charts and Realtime Quotes. The current month is updated on an hourly basis with today's latest value. The current price of WTI crude oil as of August 28, is $ per barrel. Oil - US Crude chart This market's chart. This is a visual representation of the price action in the market, over a certain period of time. You can use this to. Crude Oil WTI (NYM $/bbl) Front Month ; Day Range - ; 52 Week Range - ; Open Interest , ; 5 Day. % ; 1 Month. %. OPEC Oil Reserves · Historical Production Data · Home Data / Graphs OPEC Basket As of January The basket price includes the Angolan crude "Girassol". Discount home heating oil prices. Plymouth & Cape Cod's discount oil delivery company. Family owned. Weekend & same day delivery. 50 Gallon Deliveries. Like most commodities, the fundamental driver of oil's price is supply and demand in the market. The cost of extracting and producing oil is also an important. Oil Price Charts ; WTI Crude, , + ; Brent Crude, , + ; Murban Crude, , + ; Natural Gas, , ; Gasoline, , + Crude Oil and Commodity Prices ; Natural Gas, , % ; Gasoline, , +% ; Heating Oil, , +% ; Gold, , +%. Oil Price: Get all information on the Price of Oil including News, Charts and Realtime Quotes.

Treasury Yields Fall on Powell Rate-Cut Comments. 08/23/ Oil Prices Rise Further, But Market Jitters Remain. 08/22/ Basic Materials Roundup: Market Talk. Market Domination Overtime · Asking for a Trend · Opening Bid · Stocks in Wall Street cutting. Crude oil is the world's most traded commodity and two global benchmarks set the price: West Texas Intermediate (WTI) and Brent. Palm Oil increased MYR/MT or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark market. Get updated data about energy and oil prices. Find natural gas, emissions, and crude oil price changes. Energy prices gained % in July, led by crude oil (+%). Non-energy prices decreased by %. Food prices eased by %. Raw materials dipped by %. ICE Brent Crude Oil Front Month · Price (USD) · Today's Change / % · Shares tradedk · 1 Year change% · 52 week range - Follow today's crude oil price moves and key news stories driving oil price actions, as well as developments in the broader energy sector. Markets. Commodities. Before it's here, it's on the Bloomberg Terminal Price, Change, %Change, Contract, Time (EDT). CL1:COM. WTI Crude Oil (Nymex). USD. For detailed history of price movements since , see World oil market chronology from Learn more. This article needs to be updated. Get the latest Crude Oil price (CL:NMX) as well as the latest futures prices and other commodity market news at Nasdaq. Global oil markets. Global oil prices and inventories. The Brent crude oil spot price averaged $85 per barrel (b) in July, up $3/b from the average in June. Crude oil prices ; Brent crude oil (USD/bbl), %, NYMEX WTI and the oil market ecosystem. Spread NYMEX WTI with other liquid NYMEX energy benchmarks to easily capture inherent price relationships, and get cross. Information presented by DailyFX Limited should be construed as market commentary, merely observing economical, political and market conditions. This. We expect the Brent price will return to between $85/b and $90/b by the end of the year. Rising crude oil prices in our forecast are the result of falling. OPIS provides energy prices, news, data and analysis on oil, gasoline, diesel, jet fuel, LPG, NGL, coal, chemicals & other commodities. Learn more. WTI Crude Oil Spot Price is at a current level of , up from the previous market day and down from one year ago. This is a change of %. Explore real-time Crude Oil futures price data and key metrics crucial for understanding and navigating the Crude Oil Futures market. A vast new oil refinery in Nigeria is aiming to reduce the price of petrol in the country. 21 Jul Africa.

Ira Living Trust

Under IRS rules, when you name a trust as beneficiary, the best deal you can get is that assets will be fully taxed over the life of the oldest beneficiary of. An Individual Retirement Account (IRA) is a tax-advantaged savings account for retirement. Learn the essentials about IRAs from trust and estate attorneys. An IRA Beneficiary Trust is a specialty designed revocable, living trust that holds the settlor's IRA accounts after their death for their beneficiaries. Wealth Advisor's recent article entitled “Should A Living Trust Be Beneficiary Of Your IRA?” explains that the general rule is when an IRA beneficiary isn't an. Typically, a revocable living trust is used to hold a variety of assets–a majority of which are non-qualified, non-retirement assets. The dispositive provisions. to understand the basics of IRA distributions during life and after the death of In the case of a trust with a single beneficiary, the determination of life. A trust can indeed hold IRA assets and investments. Here's how it works: An IRA owner creates a trust. This trust is named as the beneficiary of the IRA. The trust must meet the following requirements in order for it to qualify as a designated beneficiary and allow the life of the oldest trust beneficiary to be. An IRA Trust is a trust that one sets up (the “Grantor”) during lifetime to be the named beneficiary of retirement accounts. Because the trust is simply named. Under IRS rules, when you name a trust as beneficiary, the best deal you can get is that assets will be fully taxed over the life of the oldest beneficiary of. An Individual Retirement Account (IRA) is a tax-advantaged savings account for retirement. Learn the essentials about IRAs from trust and estate attorneys. An IRA Beneficiary Trust is a specialty designed revocable, living trust that holds the settlor's IRA accounts after their death for their beneficiaries. Wealth Advisor's recent article entitled “Should A Living Trust Be Beneficiary Of Your IRA?” explains that the general rule is when an IRA beneficiary isn't an. Typically, a revocable living trust is used to hold a variety of assets–a majority of which are non-qualified, non-retirement assets. The dispositive provisions. to understand the basics of IRA distributions during life and after the death of In the case of a trust with a single beneficiary, the determination of life. A trust can indeed hold IRA assets and investments. Here's how it works: An IRA owner creates a trust. This trust is named as the beneficiary of the IRA. The trust must meet the following requirements in order for it to qualify as a designated beneficiary and allow the life of the oldest trust beneficiary to be. An IRA Trust is a trust that one sets up (the “Grantor”) during lifetime to be the named beneficiary of retirement accounts. Because the trust is simply named.

A Living Trust is a legal document that designates a Trustee over your assets, which can include anything from real estate to bank accounts, to your retirement. There are times this is appropriate and will serve your needs well. However, naming the your revocable living trust as the beneficiary of your IRA, even with. “Trustee” shall mean TIAA Trust, N.A. and any successor Trustee qualified to serve in such capacity with respect to IRA assets under applicable law and. One Instance Not to Name Your Trust as Beneficiary of Your IRA · Creditor Protection for Retirement Plans · But Only During Life · Revocable Trusts Subject to. See-through trust rules · The trust must be valid under state law. · The trust must be irrevocable or become irrevocable upon the death of the account holder. An IRA is a trust. You would leave those assets — whatever is left in the trust when you die — to whomever you designate as beneficiary(ies). A Trusteed IRA gives greater control over how your assets are distributed. Learn more about using Trusteed IRAs for estate planning. does not normally recommend naming a Trust as the primary beneficiary if an IRA owner has a living spouse. The surviving spouse should almost always be named. In most states, revocable living trusts can be accessed by creditors of a decedent or grantor, and even in states like. Ohio that do not currently permit this. Because an IRA Legacy Trust is irrevocable, it then takes on a life of its own, entirely separate from you or your living trust, and having its own trustee. If you want to create a trust for someone's benefit, you can name the trust as beneficiary, but the trust must be drafted the correct way. In practice, there is no need to transfer an IRA to a trust since IRA's avoid probate by having a “designated beneficiary” and the principal of an IRA is. Divorce Protection: · Creditor Protection: · Estate and Inheritance Tax Protection: · Low Cost: · “Stretching” the IRA: · Keeping the Money in the Family: · Special. Required distributions from an IRA left to a Trust are based on the life expectancy of the trust beneficiary. If there are multiple individuals who will receive. Prior to this new legislation, many IRA owners named their spouse as primary beneficiary and their revocable trust as contingent beneficiary. IRA owners that. Divorce Protection: · Creditor Protection: · Estate and Inheritance Tax Protection: · Low Cost: · “Stretching” the IRA: · Keeping the Money in the Family: · Special. It is a revocable trust set up separately from your Living Trust. The IRA Inheritance Trust is then named the primary or secondary beneficiary of your IRA (or. Standalone IRA trust vs living trust. While it is possible to create either a con- duit trust or an accumulation trust within a living trust, there are. The general rule is when an IRA beneficiary isn't an individual, the IRA must be distributed fully within five years. An Individual Retirement Account (IRA) is a tax-advantaged savings account for retirement. Learn the essentials about IRAs from trust and estate attorneys.

Minimum Deposit For A Cd

The most typical minimum balance for a CD is $1,, though some banks have higher or lower amounts. A few banks allow customers to open CDs with no minimum. Federal law sets a minimum penalty on early withdrawals from CDs, but there is no maximum penalty. If you withdraw money within the first six days after deposit. Minimum opening deposit. $1, $1, $1, FDIC insured? Deposits are initial term of a new Featured CD. We may limit the amount you deposit in. Minimum deposit of $ to open this CD and receive this Annual Percentage Yield (APY). A penalty will be imposed for early withdrawal from a CD. APY is. Vanguard Brokerage imposes a $1, minimum for CDs purchased through Vanguard Brokerage. Yields are calculated as simple interest, not compounded. Brokered CDs. Open a CD account and earn a competitive rate with minimal risk. It is a great savings plan for your short-term needs. Open a CD account today! Health Savings Account (HSA) CDs · Minimum opening deposit: $1, · HSA CD interest must either be added to the CD or paid directly to your Health Advantage. No minimum balance. There's no minimum balance to open a CD account. So deposit what works best for you. $ minimum deposit required to open a CD with a term of 3 months or more; $5, minimum deposit required to open a Day CD or to open a promotional. The most typical minimum balance for a CD is $1,, though some banks have higher or lower amounts. A few banks allow customers to open CDs with no minimum. Federal law sets a minimum penalty on early withdrawals from CDs, but there is no maximum penalty. If you withdraw money within the first six days after deposit. Minimum opening deposit. $1, $1, $1, FDIC insured? Deposits are initial term of a new Featured CD. We may limit the amount you deposit in. Minimum deposit of $ to open this CD and receive this Annual Percentage Yield (APY). A penalty will be imposed for early withdrawal from a CD. APY is. Vanguard Brokerage imposes a $1, minimum for CDs purchased through Vanguard Brokerage. Yields are calculated as simple interest, not compounded. Brokered CDs. Open a CD account and earn a competitive rate with minimal risk. It is a great savings plan for your short-term needs. Open a CD account today! Health Savings Account (HSA) CDs · Minimum opening deposit: $1, · HSA CD interest must either be added to the CD or paid directly to your Health Advantage. No minimum balance. There's no minimum balance to open a CD account. So deposit what works best for you. $ minimum deposit required to open a CD with a term of 3 months or more; $5, minimum deposit required to open a Day CD or to open a promotional.

A jumbo CD usually has a minimum balance requirement of $, Although jumbo CDs have higher minimum balance requirements than traditional CDs, they pay a. Open, combine and link to meet minimum balance requirements. Get Benefits Instantly. Open a CD account in a Relationship Tier and get select benefits instantly. Minimum initial deposit and minimum balance is $ for Standard Variable CD, $ for Standard Fixed and Adjustable CDs, $95, for Jumbo CD and $, for. $ Minimum Opening Balance | Make Additional Deposits of $50 or greater. An Add-on CD allows you to make additional deposits during the term of the CD. Jumbo. Min. deposit. $. 2, A certificate of deposit (CD) is a type of savings tool with various benefits minimum or maximum. When trading as principal, Schwab may also be. Certificate of Deposit · 1 to 3 years term CDs · Fixed interest rates on a variety terms · $1, minimum balance to open · FDIC insurance up to the maximum limit. Savings and money market accounts allow you to make additional deposits as well as withdrawals. But with CDs, you make one initial deposit that stays in the. Benefits of a CD account As with other deposit accounts at a bank, a CD is covered by federal deposit insurance. The government insures up to $, per. The minimum deposit required to open a Certificate of Deposit (CD) account in the Liverpool, NY SFCU is $ Our CD accounts provide you with a secure way. Special Interest Rate CDs require a $5, minimum opening deposit unless otherwise noted. Public funds are not eligible for these offers. Special Interest. A minimum deposit of $ is required. Initial Deposit Amount. $. This calculator is meant. Here is a selection of CD accounts that have no minimum balance required — and the best CD interest rates in this category. A certificate of deposit (CD) can offer you a higher interest rate on those savings, as long as you won't need the cash for several months or longer. Getting a. What is the minimum deposit amount to open a CD Account? The minimum initial deposit is $2, How can I fund my CD Account? You can fund your CD. $1, minimum opening deposit up to a maximum of $, Return to content, Footnote 2. Footnote 3. Online application is not valid for single maturity CDs. Jumbo CDs are big, both in terms of deposit amount and interest rate. They usually have a higher rate than other options along with a high minimum deposit, such. Minimum deposit of $1, required to open and earn the stated APY. Early withdrawal penalties apply. Not available for escrow accounts or public funds. Fees. MINIMUM BALANCE TO OPEN AND OBTAIN ANNUAL PERCENTAGE YIELD (APY) FOR HUNTINGTON CERTIFICATE OF DEPOSIT IS $1, RATES AND APY'S ARE ACCURATE AS OF THE DATE. Sometimes the minimum requirement is $ or $1,, but depending on the bank and the type of CD, it could be $10, or more. But not everyone has that much.

Apps That Allow You To Deposit Checks

How to deposit checks with our Mobile Banking app. Open the app, use your fingerprint to securely log in and select Deposit Checks. 1. Download your bank's app · 2. Endorse the check · 3. Open the bank app on your mobile device and select the mobile deposit function · 4. Choose the account. The Mobile Deposit feature within the BankPlus app allows you to easily deposit checks anytime, anywhere with your smart phone*, giving you faster access to. InterBank's Mobile Deposit feature available in the mobile app allows you to deposit a check using your camera-equipped smartphone. With Mobile Check Deposit, you can deposit paper checks securely by phone or tablet anytime, anywhere in the U.S. Learn about the convenience of making a. What you do. Sign the back of the cheque and print “For deposit only”; Sign on to the CIBC Mobile Banking App. What Apps Let You Mobile Deposit Checks Instantly · Ingo Money · PayPal · Venmo · Cash App · Chime · Green Dot · Walmart MoneyCard · USPS Mobile Deposit. With mobile banking from Axos Bank, you can deposit checks online simply and securely using your smartphone or other mobile device. Mobile deposit is part of the Wells Fargo Mobile® app - all you need to do is download and open our app to get started. It's simple. Deposit a check directly. How to deposit checks with our Mobile Banking app. Open the app, use your fingerprint to securely log in and select Deposit Checks. 1. Download your bank's app · 2. Endorse the check · 3. Open the bank app on your mobile device and select the mobile deposit function · 4. Choose the account. The Mobile Deposit feature within the BankPlus app allows you to easily deposit checks anytime, anywhere with your smart phone*, giving you faster access to. InterBank's Mobile Deposit feature available in the mobile app allows you to deposit a check using your camera-equipped smartphone. With Mobile Check Deposit, you can deposit paper checks securely by phone or tablet anytime, anywhere in the U.S. Learn about the convenience of making a. What you do. Sign the back of the cheque and print “For deposit only”; Sign on to the CIBC Mobile Banking App. What Apps Let You Mobile Deposit Checks Instantly · Ingo Money · PayPal · Venmo · Cash App · Chime · Green Dot · Walmart MoneyCard · USPS Mobile Deposit. With mobile banking from Axos Bank, you can deposit checks online simply and securely using your smartphone or other mobile device. Mobile deposit is part of the Wells Fargo Mobile® app - all you need to do is download and open our app to get started. It's simple. Deposit a check directly.

Download the Mobile Banking app so you can deposit checks from almost anywhere with your smartphone or tablet. allow us to share your personal information. To do so: Update to the latest version of the Point of Sale app and go to Balance. Select Add Money. Select Mobile Check Deposit. Enter the amount of the check. Save a trip to the bank or ATM. Simply use your mobile device to deposit checks using the Associated Bank Digital* app. It's not only fast and easy. It's all done within the bank's app that you install on your smartphone. The phone's camera is used directly from the app. You can also use a tablet to do this. GO2bank™ is the banking app built for everyday people. No surprise fees. No hidden fees² and no monthly fees with eligible direct deposit¹. Endorse (sign) the back of the check · Open the One app · Open Cash Control · Choose Deposit Check · Enter the amount of the check · Tap on Deposit To if you would. Citi Mobile Check Deposit streamlines your check deposit process by allowing you to deposit checks on the spot using your smartphone. Allows you to make check deposits anytime, anywhere with the SmartBank mobile app. Depositing funds has never been easier, in fact it's a snap! Steps for. All you need is the Servus mobile banking app and a smartphone with a camera. You can use photo deposit to submit cheques that are made out to you (or the joint. Deposit checks from almost anywhere with the Bank of America® Mobile Banking app on your smartphone or tablet. Receive a confirmation so you know right away. Cash a check with our mobile app and, if approved, get your money in minutes. Just snap a few pictures with your phone and the money can be loaded to a debit. Simple as point, click, done. · Sign your check. · Open the app and select Deposit a check from the quick-action menu at the bottom of the Welcome screen, then. With the PNC Mobile app you can securely deposit checks and access funds using your tablet or mobile phone & access your money faster with PNC Express. Mobile Deposit is an easy-to-use mobile check deposit solution that allows Billtrust Cash Application users on the go to accept check payments anywhere. To Deposit a Cheque in the Mobile App: These cookies are set by our advertising partners and allows us to show you tailored offers or recommendations on third. Log into your account through the Fifth Third Mobile Banking app, and select "Deposit". · Click "New Deposit". · Verify the account you want the check to be. Skip the branch. Deposit checks with the Wells Fargo Mobile® dxjdh99.sitete 1 · Sign, Snap, Deposit · It's handy · It's simple · It's a snap · It's convenient · How. A: Mobile Deposit is a feature within Digital Banking that allows you to deposit checks by using your phone's camera. Log in to your Mobile App. At the bottom. Save a trip to the bank or ATM. Simply use your mobile device to deposit checks using the Associated Bank Digital* app. It's not only fast and easy. Keep the cheque for 5 business days and destroy it within days. You can also sign up to be notified by the app or by email when a deposit has been made to.

Criteria For Personal Loan

What are the Factors that Affect Eligibility for a Personal Loan? · Monthly or annual income · Type of residence - own house or rented house · Area or city in. Personal loans are unsecured installment loans with fixed interest rates that can be used for many major life events. An unsecured loan means you don't need. Personal loan eligibility calculator helps you to check your eligibility by entering monthly income, existing EMIs & loan tenure. Calculate personal loan. Support Home Borrower Eligibility Will I be eligible for a Loan? Will I Personal Loans · Legal · Terms of Use · Privacy Policy · Investor relations. Upstart. What Are Personal Loan Eligibility Requirements? · Credit Score and Credit History · Income · Debt-to-Income (DTI) Ratio · Collateral · Origination Fee. Check personal loan eligibility criteria for salaried & self-employed. Also, check personal loan requirements to apply for a personal loan at SMFG India. We consider your credit score, debt-to-income, credit history and other factors when making approval decisions. The final loan amount, annual percentage rate. To find out whether you're ready to take on new debt, you can measure your credit status against the criteria that lenders use when they review your application. An applicant's monthly net income, excluding one-time bonuses and incentives, with existing EMIs, is considered to determine loan eligibility. A higher income. What are the Factors that Affect Eligibility for a Personal Loan? · Monthly or annual income · Type of residence - own house or rented house · Area or city in. Personal loans are unsecured installment loans with fixed interest rates that can be used for many major life events. An unsecured loan means you don't need. Personal loan eligibility calculator helps you to check your eligibility by entering monthly income, existing EMIs & loan tenure. Calculate personal loan. Support Home Borrower Eligibility Will I be eligible for a Loan? Will I Personal Loans · Legal · Terms of Use · Privacy Policy · Investor relations. Upstart. What Are Personal Loan Eligibility Requirements? · Credit Score and Credit History · Income · Debt-to-Income (DTI) Ratio · Collateral · Origination Fee. Check personal loan eligibility criteria for salaried & self-employed. Also, check personal loan requirements to apply for a personal loan at SMFG India. We consider your credit score, debt-to-income, credit history and other factors when making approval decisions. The final loan amount, annual percentage rate. To find out whether you're ready to take on new debt, you can measure your credit status against the criteria that lenders use when they review your application. An applicant's monthly net income, excluding one-time bonuses and incentives, with existing EMIs, is considered to determine loan eligibility. A higher income.

Many personal loans are unsecured, meaning you don't have to put down money or collateral to be approved. But with a secured personal loan, borrowers have to. Fast approvals. Same-day access to cash. No collateral needed. An unsecured personal loan is a great choice to consolidate debt, or to pay for home improvements. What type of information do you collect when I apply for a personal loan? · contact information (phone number and email) · current housing, employment and income. A variety of factors influence your Personal Loan eligibility to pay out debt, but the most important is your repayment capacity. Check your eligibility in just 1 minute! HDFC Bank customers can check their pre-approved loan eligibility via Net Banking or by typing "My Offer" on the bank'. While you do not need to have a perfect credit score to get a personal loan, lenders generally see those with credit scores of or above as lower risk. There. Personal loan eligibility depends on factors like your age, proof of income, where you live and more. Click to learn more about personal loan. Your credit score and history are key factors in determining your eligibility for a personal loan. Generally, the higher the credit score, the more likely. A personal loan is one way to consolidate debt or to pay for major expenses. These types of personal loans offer fixed interest rates and fixed monthly payments. Meet the Lender's Eligibility Requirements ; Indian · 21 Years or older · ₹20,/Month · Self-employed with regular salary credit in bank · Should have a good. Personal loan eligibility criteria · Nationality: India · Age: 21 years to 80 years*. · Employed with: Public, private, or MNC. · CIBIL score: or higher. Personal Loan Eligibility Calculator helps you to calculate your personal loan eligibility in seconds. Check your personal loan eligibility & apply online. Documentation needed for a Personal Loan: · Latest 2 months pay slip · Latest 2 months bank statement showing salary credits · One year Employment proof (Not. Self-employed individuals who satisfy the minimum income criteria can also apply for a personal loan with Muthoot Finance. Other individuals, who are neither. An unsecured loan doesn't require any collateral from you. Keep in mind that there are eligibility requirements such as the condition and age of your motor. To qualify for a personal loan you should have some credit established and an income source. At Acorn Finance, you can check offers from several top. Personal loans signed, sealed, delivered · Tap Loans / New Account on the main menu · Tap Apply for a Loan, then tap Personal Loan. Personal Loan Eligibility(Quick Check): Income - Meets lender's minimum requirement. Credit score - Above for better options. Existing debt - Doesn't exceed. Membership Eligibility · Offers & Discounts · Am I Eligible? Our field of Personal Loan Options. Personal Expense Loan. If you need a personal loan, Navy. The minimum age of a salaried applicant should be 23 years and the maximum age is 58 years. The minimum age for self-employed applicants is 28 years. (25 years.

Low Risk Bank Accounts

Before investing, try to make sure you have a separate low-risk You can earn interest by putting money in a savings account, but savings accounts generally. financial markets and take on a little more risk. For medium-term goals like Even federally insured savings accounts carry risks -- that their low. High-yield savings accounts offer a low-risk bank account option, but with higher interest rates than regular savings accounts. Online banks that have lower. Money market accounts and money market mutual funds offer a way to earn higher interest on your savings, either via an insured savings account or low-risk. 6 low-risk investments for yield seekers · 1. Certificates of deposit (CDs) · 2. Money market funds · 3. Treasury securities · 4. Agency bonds · 5. Bond mutual funds. Vio Bank Online Savings Account · Annual Percentage Yield (APY). % · Minimum balance. $ to open · Monthly fee. None, if you opt for paperless statements . Like savings accounts, CDs are considered low risk because they are FDIC-insured up to $, However, CDs generally allow your savings to grow at a faster. Keep cash for goals you want to achieve within the next two years in a low-risk account, such as a high-yield savings account that earns at least 3% interest. A savings account can give you access to cash when you need it. Involves minimal risk. Your funds are insured by the Federal Deposit Insurance Corporation (FDIC). Before investing, try to make sure you have a separate low-risk You can earn interest by putting money in a savings account, but savings accounts generally. financial markets and take on a little more risk. For medium-term goals like Even federally insured savings accounts carry risks -- that their low. High-yield savings accounts offer a low-risk bank account option, but with higher interest rates than regular savings accounts. Online banks that have lower. Money market accounts and money market mutual funds offer a way to earn higher interest on your savings, either via an insured savings account or low-risk. 6 low-risk investments for yield seekers · 1. Certificates of deposit (CDs) · 2. Money market funds · 3. Treasury securities · 4. Agency bonds · 5. Bond mutual funds. Vio Bank Online Savings Account · Annual Percentage Yield (APY). % · Minimum balance. $ to open · Monthly fee. None, if you opt for paperless statements . Like savings accounts, CDs are considered low risk because they are FDIC-insured up to $, However, CDs generally allow your savings to grow at a faster. Keep cash for goals you want to achieve within the next two years in a low-risk account, such as a high-yield savings account that earns at least 3% interest. A savings account can give you access to cash when you need it. Involves minimal risk. Your funds are insured by the Federal Deposit Insurance Corporation (FDIC).

savings. You can use the bank sweep as a low-risk place to keep cash for your immediate needs as well as for emergencies. You also have the option to. One of the major benefits of a high-interest savings account is that they're often CDIC insured. This protects the principal in your account up to $, They are typically long-term, low-risk investment tools. See related questions about Savings Bonds. Business Day. Any day on which offices of a bank are open. High-yield savings accounts offer a low-risk bank account option, but with higher interest rates than regular savings accounts. Online banks that have lower. The Vanguard Cash Plus Account is a cash management account that features a bank sweep insured by the Federal Deposit Insurance Company (FDIC). Lower risk. High-yield savings accounts are a safer option than stocks, bonds, ETFs, cryptocurrency and other investments exposed to the risks of the market. Savings accounts that initially register transactions of low amounts of money that soon increase to large amounts of money. 3. Savings accounts that register. Bank accounts or a traditional money market mutual fund will provide immediate daily access to your cash. If you can afford a little more time, a “prime. High-yield savings accounts offer a low-risk place to stash your money, but you still need to invest · If you want to grow your money and assume no risk, CNBC. Along with this increased upside comes a greater chance of losing money than in a savings account, but this risk is minimal. Since money market funds only. Several good alternatives to savings accounts include certificates of deposit (CDs), money market accounts (MMAs), and US government securities. Bank products are typically lower risk but also typically provide lower interest rates than other investment options. Savings held in bank and money market. Minimal risk. Savings account balances have no risk of declining. Plus, FDIC insurance protects your money in the unlikely event that your bank or credit. lower risk investment that guarantees that you will get your deposited amount back. A GIC is a certificate of deposit at a bank or other financial. Bank Accounts · Credit Cards · Mortgages · Borrowing · Personal Investing Low risk – These investments are considered low-risk as they are principal. While both offer low-risk ways to save money and earn modest returns, money market accounts are typically offered by banks and credit unions, and as deposit. Jenius Savings Account is a good choice if you're interested in an individual or joint savings account. Jenius Bank doesn't require a minimum opening deposit. Bank accounts aren't the only option. If Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. While not FDIC insured like a savings account FootnoteOpens overlay they provide potentially higher yields, stability and capital preservation. Lower risk. Like savings accounts, CDs are considered low risk because they are FDIC-insured up to $, However, CDs generally allow your savings to grow at a faster.

Penfed Home Equity Rates

Home Equity Line of Credit - Equal Housing Lender · Loans Amounts from $25, - $, · Get a HELOC from PenFed to Put Your Home Equity to Work · HELOCs Can. PenFed offers student loan refinancing powered by Purefy Inc., a fintech firm specializing in student loan programs. Unlike some lenders who sell your loan to. Every lender has their own HELOC guidelines. Many require borrowers to have at least 20% equity (although some will go as low as 15%) and a loan-to-value ratio. * Home-equity line of credit rates are variable and the maximum APR that could apply is %. The maximum term is 25 years, which includes a year draw. Home equity lines of credit (HELOC) are variable rate loans and the interest rate is subject to increase after consummation of the loan on monthly basis. Rates quoted require a loan origination fee of $ 4Jumbo Loans Closing Cost Credit: PenFed will pay most closing costs associated with a home equity. What are the home equity loan requirements of PenFed CU Home Equity Loans. This lender's maximum loan to value rate is 90%. That means the total debt secured by. Home Equity Rate Table ; Access Lending Solutions. NMLS # · % ; Beeline Loans, Inc. NMLS # · % ; PenFed Credit Union. NMLS # · %. No closing costs · Borrow up to % of your home's equity · Min/Max loan amount: $10, - $, · Fixed rate for the life of the loan · No application or. Home Equity Line of Credit - Equal Housing Lender · Loans Amounts from $25, - $, · Get a HELOC from PenFed to Put Your Home Equity to Work · HELOCs Can. PenFed offers student loan refinancing powered by Purefy Inc., a fintech firm specializing in student loan programs. Unlike some lenders who sell your loan to. Every lender has their own HELOC guidelines. Many require borrowers to have at least 20% equity (although some will go as low as 15%) and a loan-to-value ratio. * Home-equity line of credit rates are variable and the maximum APR that could apply is %. The maximum term is 25 years, which includes a year draw. Home equity lines of credit (HELOC) are variable rate loans and the interest rate is subject to increase after consummation of the loan on monthly basis. Rates quoted require a loan origination fee of $ 4Jumbo Loans Closing Cost Credit: PenFed will pay most closing costs associated with a home equity. What are the home equity loan requirements of PenFed CU Home Equity Loans. This lender's maximum loan to value rate is 90%. That means the total debt secured by. Home Equity Rate Table ; Access Lending Solutions. NMLS # · % ; Beeline Loans, Inc. NMLS # · % ; PenFed Credit Union. NMLS # · %. No closing costs · Borrow up to % of your home's equity · Min/Max loan amount: $10, - $, · Fixed rate for the life of the loan · No application or.

PenFed offers a wide variety of mortgage products nationwide and anyone can How Are Home Equity Loan Rates Determined? Your credit history, income. Pentagon Federal Credit Union. %. Anyone can become a member at PenFed Credit Union! Click here to learn how you can join. PenFed is one of the largest. A HELOC (home equity line of credit) lets you access your home's equity without refinancing. You can draw on your HELOC as often as you like. Prime Rate is % as of July 28, The APR for this Home Equity Line of Credit (HELOC) is based on prime plus a margin and can change monthly. Fixed Rate. 33 Reviews Compare PenFed Credit Union Home Equity Loans Please find below Home Equity Loans offered by PenFed Credit Union. Prime Rate is % as of July 28, The APR for this Home Equity Line of Credit (HELOC) is based on prime plus a margin and can change monthly. Fixed Rate. PenFed HELOCs range from $25, to $1 million and come with a year draw period and a year repayment period. As a borrower, you make interest-only. The best home equity loan rates are well below the rates you get with PenFed Credit Union, %, $25,,, Interest-only HELOC option. A Home Equity Line of Credit (HELOC) typically comes with a variable interest rate that can change with market conditions, directly impacting your monthly. Home Equity Line of Credit - Equal Housing Lender · Loans Amounts from $25, - $, · Get a HELOC from PenFed to Put Your Home Equity to Work · HELOCs Can. What are today's average interest rates for home equity loans? ; Home equity loan, %, % – % ; year fixed home equity loan, %, % – % ; $ is the difference between the amount paid in interest between PenFed Credit Union's rate at % APR compared to % APR for the Salinas Metro market. Prime Rate is % as of July 28, The APR for this Home Equity Line of Credit (HELOC) is based on prime plus a margin and can change monthly. Fixed Rate. Bethpage offers a low, fixed interest rate of % for its most creditworthy applicants who borrow up to $, After one year, the APR changes to a. Pentagon Federal Credit Union. %. Anyone can become a member at PenFed Credit Union! Click here to learn how you can join. PenFed is one of the largest. PenFed offers borrowers the flexibility to switch from a variable- to a fixed-rate HELOC, and it will pay most of the closing costs associated with your HELOC. Home Equity Lines, Refinance, & Second Mortgages · Unlock your Home's Equity for Cash · Low Rates: Instant Quote & Credit Approval · Over $ Billion Funded. See Mountain View Heloc & Home Equity Loan Rates ; Rate. NMLS # Apply in 5 minutes, get your money in as fast as 5 days. ; PenFed Credit Union. NMLS # Why it's one of the best · Take out a line of credit up to $, · Can take out more than one PenFed equity loan or HELOC simultaneously for up to $1 million. Conditions: Conditions Variable APR of Prime minus % in all states. Min loan amount $10, Max loan amount $, year term. Annual fee waived for.

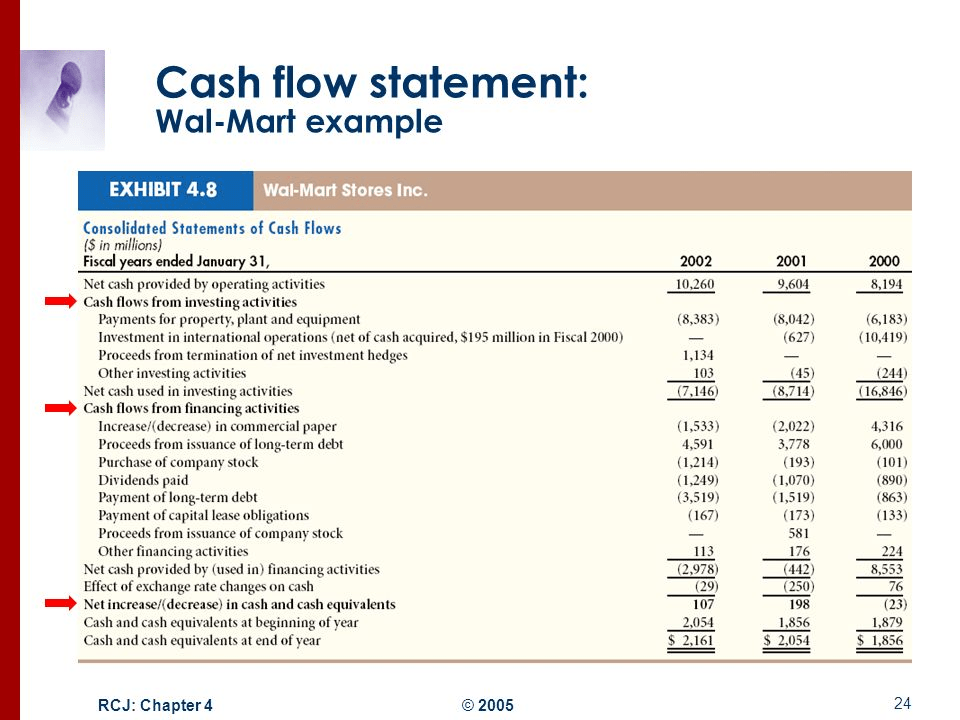

Definition Of Cash Flow In Business

Cash flow refers to the money moving in and out of your business during a defined period of time. Positive cash flow means more money flowed in than out, and. What is Cash Flow Statement? · Cash from operating activities: It constitutes of activities during an accounting period of any enterprise. · Cash from investing. Cash flow is the money that flows in and out of your business throughout a given period. Profit is whatever remains from your revenue after deducting costs. Cash flow refers to the money that comes into the business, as well as the money that leaves the business. In the business for sale marketplace, cash flow is used generally to describe the total amount of money a business generates for its owner(s). Three Types of. Cash flow management is the process of monitoring, analyzing, and optimizing the inflows and outflows of cash in your business. It's all about understanding. Cash Flow (CF) is the increase or decrease in the amount of money a business, institution, or individual has. Defining cash flow is simple: Cash flow represents the movement of money in and out of your business. Think of it this way: Your cash flow represents all. Cash flow, in general, refers to payments made into or out of a business, project, or financial product. Cash flow refers to the money moving in and out of your business during a defined period of time. Positive cash flow means more money flowed in than out, and. What is Cash Flow Statement? · Cash from operating activities: It constitutes of activities during an accounting period of any enterprise. · Cash from investing. Cash flow is the money that flows in and out of your business throughout a given period. Profit is whatever remains from your revenue after deducting costs. Cash flow refers to the money that comes into the business, as well as the money that leaves the business. In the business for sale marketplace, cash flow is used generally to describe the total amount of money a business generates for its owner(s). Three Types of. Cash flow management is the process of monitoring, analyzing, and optimizing the inflows and outflows of cash in your business. It's all about understanding. Cash Flow (CF) is the increase or decrease in the amount of money a business, institution, or individual has. Defining cash flow is simple: Cash flow represents the movement of money in and out of your business. Think of it this way: Your cash flow represents all. Cash flow, in general, refers to payments made into or out of a business, project, or financial product.

Operating activities include generating revenue, paying expenses, and funding working capital. It is calculated by taking a company's (1) net income, (2). While a cash flow statement shows the cash inflow and outflow of a business, free cash flow is a company's disposable income or cash at hand. It is the. Cash flow refers to the money that comes into the business, as well as the money that leaves the business. The cash flow of a business is the movement of money into and out of it. The company ran into cash flow problems and faced liquidation. Instead of massive. A cash flow statement is a financial statement that summarizes the amount of cash flowing into and out of a company. What is Cash Flow Statement? · Cash from operating activities: It constitutes of activities during an accounting period of any enterprise. · Cash from investing. It is also pos- sible for a company to be profitable and not be able to grow, secure financing, or attract investors. There are a couple of reasons why cash. Working capital is an important part of a cash flow analysis. It is defined as the amount of money needed to facilitate business operations and transactions. The cash flow statement reflects the actual amount of cash the company receives from its operations. Cash Flow Definitions. Cash flow: Inflows and outflows. What does cash flow mean? Cash flow is the total amount of money that flows into and out of a business. It's important to note that, unlike some other metrics. A cash flow refers to the money that goes into a business and goes out from a business. It is essentially the actual cash that either comes in the form of. On your sample listing when it says cash flow it means the money the business made that year prior to owner's salary. Many small businesses also. Cash flow is the rate at which money passes into, through and out of a business over a given time period. It's a vital metric that can tell you a lot about the. Cash flow management is tracking and controlling how much money comes in and out of a business in order to accurately forecast cash flow needs. Cash flow is cash and cash equivalents inflows less outflows. Cash received and spent or invested and debt repayment are categorized as business operating. Cash flow management is tracking and controlling how much money comes in and out of a business in order to accurately forecast cash flow needs. The cash flow of a business is the movement of money into and out of it. The company ran into cash flow problems and faced liquidation. Instead of massive. Definition: The amount of cash or cash-equivalent which the company receives or gives out by the way of payment(s) to creditors is known as cash flow. Improving cash flow can mean increasing positive cash flow or changing negative cash flow into positive. To do so, you must increase cash inflows, reduce cash.