dxjdh99.site Gainers & Losers

Gainers & Losers

Making Money From Uber Eats

Any remaining earnings, including anything you earn from referral rewards and promotions, will be transferred to your bank account by the end of the week. Why. Uber Eats: Decoded: An Inside Guide To Help You Make More Money [Number 1, Uber Eats Driver, Number 2, Uber Eats Driver] on dxjdh99.site Use this page to understand all of the earning opportunities for making money with Uber Eats. Learn how to decide when and where it's best to deliver. By foot or bike. In most cities where Uber Eats is available, you can deliver by bike or foot. · On a motorcycle. If you drive a motorcycle, you can earn more by. It's your hustle. Our flexibility. Your independence. Our security. Your business. Our support. Here's why you should drive, deliver, and earn money with. You can tap your earning cards and swipe right and left to see your daily and weekly earnings at a glance. You can also get more details in the Earnings section. Uber Eats drivers can expect to make an average of $ an hour, according to Indeed. Depending on how many deliveries you make per week and the hours worked. While ZipRecruiter is seeing hourly wages as high as $ and as low as $, the majority of Uber Eats Delivery Driver wages currently range between $ Uber Eats' business model combines a multi-sided platform, aggregator, and on-demand. The model includes customers, delivery partners, and restaurant partners. Any remaining earnings, including anything you earn from referral rewards and promotions, will be transferred to your bank account by the end of the week. Why. Uber Eats: Decoded: An Inside Guide To Help You Make More Money [Number 1, Uber Eats Driver, Number 2, Uber Eats Driver] on dxjdh99.site Use this page to understand all of the earning opportunities for making money with Uber Eats. Learn how to decide when and where it's best to deliver. By foot or bike. In most cities where Uber Eats is available, you can deliver by bike or foot. · On a motorcycle. If you drive a motorcycle, you can earn more by. It's your hustle. Our flexibility. Your independence. Our security. Your business. Our support. Here's why you should drive, deliver, and earn money with. You can tap your earning cards and swipe right and left to see your daily and weekly earnings at a glance. You can also get more details in the Earnings section. Uber Eats drivers can expect to make an average of $ an hour, according to Indeed. Depending on how many deliveries you make per week and the hours worked. While ZipRecruiter is seeing hourly wages as high as $ and as low as $, the majority of Uber Eats Delivery Driver wages currently range between $ Uber Eats' business model combines a multi-sided platform, aggregator, and on-demand. The model includes customers, delivery partners, and restaurant partners.

Customers can add tips up to 7 days after delivery. Any money made from tips is entirely yours, as Uber Eats doesn't take a service fee for tips. You can read. Doing Uber Eats can be a great way to earn extra money in your spare time. With Uber Eats, you get to set your own schedule and be your own boss. Want to know how much Uber Eats Pays? Drivers earn $18 per hour on average. It's a great way to get paid fast and set your own schedule. But how does Uber Eats make money? The company charges a commission on each order, typically around %. This fee covers the cost of operating the platform. You'll get paid for every pickup and dropoff you complete, plus a per-mile rate. In some cities, you'll also receive a per-minute rate. In addition, Uber Eats. Driving for Uber Eats allows you to deliver food to customers from hundreds of different restaurants around the world while receiving around $6 to $7 for each. So obviously in tips, I made around $ Promotions, though, I made a hundred and fifty cents. So let me tell you something. When you're doing Uber deliveries. Here are 11 tips on how to round up, earn more money by delivering food with Uber Eats. The opportunities to easily earn more money with Uber Eats exist. On average, Uber Eats drivers earn around $8 to $12 per hour after expenses. But if you're willing to ride the high tides of lunch and dinner times, you could. In , the gig economy continues to offer opportunities for individuals to earn money through platforms like Uber Eats. However, it's crucial to recognize. Any remaining earnings, including anything you earn from referral rewards and promotions, will be transferred to your bank account by the end of the week. Why. Making More Money as a Uber Eats Driver In any case, if you want to make $ per week working as an Uber Eats driver, you must take your driving seriously. On average, UberEats drivers usually make about $18 per hour before expenses, making this a potentially decent income. Uber Eats delivery drivers earn anywhere from $ to $ per hour. The amount delivery partners earn depends on their location, delivery fee, surge pricing. How can I work with UberEats? UberEats delivery drivers are also self-employed. Working with UberEats should give you the flexibility to work the hours you want. How much you can earn with Uber Eats varies a lot based on how often you deliver, where you're located, and the demand for orders in your area. Uber Eat's. App has been a great filler for a part time job, and allows you to make money that is suitable for you. There are some bugs though, such as the acceptance. Your business will be discovered more frequently in the Uber Eats app² · Uber One benefits ($0 Delivery Fee and discounts) apply to member customers ordering. 7 Uber Eats Driver Hacks To Rake In More Money · 1. First, Understand How It All Works · 2. Cash In On Promotions · 3. Work At The Right Times · 4. Location. This Uber Eats driver made $ in one month delivering food 12 hours a day. Here's how he did it — and documented the journey on Tik Tok.

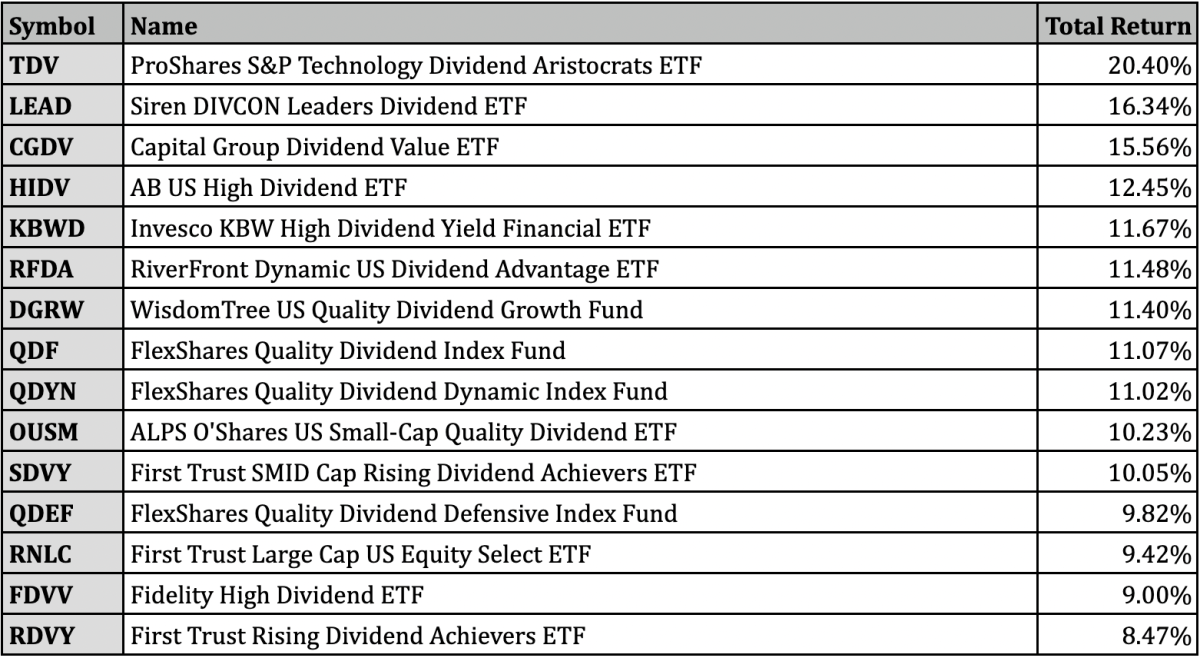

Etfs And Dividends

+/- Inflation Adjustment (TIPS ETFs only) +/- FX gains/losses (ETFs with foreign currency only). • Equity earned income = Dividends from equities + taxable. The Global X SuperDividend® US ETF (DIV) invests in 50 of the highest dividend yielding equity securities in the United States. If you own shares in ETF, you may receive distributions in the form of dividends. Learn more about ETFs and dividends here. Explore dividend-paying solutions. Dividend ETFs for income-seeking investors. Download the RBC iShares dividend brochure. Advantages of Dividend ETFs · Stable income stream: Dividend ETFs offer investors a reliable income stream through regular dividend payments from the underlying. Dividend ETFs and dividend stocks have multiple similarities, such as income generation and overall market risk. This is a list of all Dividend ETFs traded in the USA which are currently tagged by ETF Database. Please note that the list may not contain newly issued ETFs. Dividend funds are stock picking funds. That's why you should avoid them. They don't provide any income that the "sell" button cannot provide on VTI. What are dividend ETFs? These ETFs (exchange-traded funds) typically hold stocks that have a history of distributing dividends to their shareholders. However. +/- Inflation Adjustment (TIPS ETFs only) +/- FX gains/losses (ETFs with foreign currency only). • Equity earned income = Dividends from equities + taxable. The Global X SuperDividend® US ETF (DIV) invests in 50 of the highest dividend yielding equity securities in the United States. If you own shares in ETF, you may receive distributions in the form of dividends. Learn more about ETFs and dividends here. Explore dividend-paying solutions. Dividend ETFs for income-seeking investors. Download the RBC iShares dividend brochure. Advantages of Dividend ETFs · Stable income stream: Dividend ETFs offer investors a reliable income stream through regular dividend payments from the underlying. Dividend ETFs and dividend stocks have multiple similarities, such as income generation and overall market risk. This is a list of all Dividend ETFs traded in the USA which are currently tagged by ETF Database. Please note that the list may not contain newly issued ETFs. Dividend funds are stock picking funds. That's why you should avoid them. They don't provide any income that the "sell" button cannot provide on VTI. What are dividend ETFs? These ETFs (exchange-traded funds) typically hold stocks that have a history of distributing dividends to their shareholders. However.

Vanguard High Dividend Yield ETF (VYM) - Find objective, share price, performance, expense ratio, holding, and risk details. Given the growing popularity of exchange-traded funds (ETFs) and the proven benefits of dividend investing strategies, it becomes imperative to explore ETFs. The T. Rowe Price Dividend Growth ETF (TDVG) seeks dividend income and long-term capital growth primarily through the common stocks of dividend-paying. The SmartETFs Dividend Builder ETF acquired the assets and liabilities of the predecessor mutual fund, the Guinness Atkinson Dividend Builder Fund, on March Dividend ETFs are designed to provide regular income to investors by investing in a diversified basket of dividend-paying equities. The selection of stocks. Distributing ETFs pay out all dividends they receive. They are most suited to investors who are investing for regular income. Learn more about VanEck Dividend. ETFs paying monthly dividends are popular with investors willing to better manage cash flows and ensure predictable income. The ETFs listed above have historically paid dividends to investors and/or invest in the securities of dividend paying issuers; however, there is no. Dividend growth ETFs tap into a strategy that beats the market over time and helps investors beat inflation. The iShares Core High Dividend ETF seeks to track the investment results of an index composed of relatively high dividend paying U.S. equities. The TD Enhanced Dividend ETFs were designed to resolve the specific challenge of balancing growth and income in the search for yield. The strategy behind. Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company will. The best global dividend ETF by 1-year fund return as of ; 1, Franklin Global Quality Dividend UCITS ETF, +% ; 2, Fidelity Global Quality Income. Dividend stocks can provide a regular source of income and help investors meet current spending needs. THE CASE. FOR DIVIDEND. ETFs. 4 DIG DEEPER INTO DIVIDENDS. The following table lists the top exchange-traded funds with the highest dividend yields. The dividend yield is calculated by dividing the most recent. The short answer is yes. ETFs pay dividends if they hold stocks that pay dividends. However, not all ETFs pay dividends. For example, fixed income ETFs pay. Two of our top dividend ETFs for this year focus on dividend growth: The Vanguard Dividend Appreciation ETF (VIG %) and iShares Core Dividend Growth ETF . Top Dividend ETFs For less than $10 per month, a Barchart Plus Membership lets you pull these symbols into the Screener to further apply filters that match. If a stock is held in an ETF and that stock pays a dividend, then so does the ETF. While some ETFs pay dividends as soon as they are received from each company. How do ETF dividends work? ETFs pool the dividends of multiple individual stocks, paying you a collective sum from several sources. If a fund has shares of.

Gap Insurance Stand Alone

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car's. More specifically, GAP insurance will cover that difference in the case of a total loss and theft, but it will not cover deductible costs. In addition, it. Our Guaranteed Asset Protection (GAP) coverage protects you from paying large out-of-pocket expenses for the “gap” between your insurance settlement and the. GUARANTEED ASSET PROTECTION (GAP) PAYOFF EXAMPLE Guaranteed Asset Protection, also known as GAP, covers the financial gap between the actual cash value of a. GUARANTEED ASSET PROTECTION (GAP) PAYOFF EXAMPLE Guaranteed Asset Protection, also known as GAP, covers the financial gap between the actual cash value of a. You can get it as standalone coverage from a separate company. Or you can buy it from the auto dealership when you purchase or lease your vehicle. If you get. Some insurers might sell gap insurance as a standalone insurance policy, but it's more commonly added to your existing auto insurance policy. Note that lenders. Gap insurance is an optional coverage available from car insurers and dealers · It can help pay off your loan if your car is stolen or totaled and you owe more. Loan or lease gap coverage pays the difference, or “gap,” between the actual cash value of your vehicle and the unpaid balance on your loan or lease if your. Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car's. More specifically, GAP insurance will cover that difference in the case of a total loss and theft, but it will not cover deductible costs. In addition, it. Our Guaranteed Asset Protection (GAP) coverage protects you from paying large out-of-pocket expenses for the “gap” between your insurance settlement and the. GUARANTEED ASSET PROTECTION (GAP) PAYOFF EXAMPLE Guaranteed Asset Protection, also known as GAP, covers the financial gap between the actual cash value of a. GUARANTEED ASSET PROTECTION (GAP) PAYOFF EXAMPLE Guaranteed Asset Protection, also known as GAP, covers the financial gap between the actual cash value of a. You can get it as standalone coverage from a separate company. Or you can buy it from the auto dealership when you purchase or lease your vehicle. If you get. Some insurers might sell gap insurance as a standalone insurance policy, but it's more commonly added to your existing auto insurance policy. Note that lenders. Gap insurance is an optional coverage available from car insurers and dealers · It can help pay off your loan if your car is stolen or totaled and you owe more. Loan or lease gap coverage pays the difference, or “gap,” between the actual cash value of your vehicle and the unpaid balance on your loan or lease if your.

The average gap insurance cost, in this case, ranges from $ to $ Purchasing standalone gap insurance: Some auto insurers don't offer gap insurance as. Gap insurance coverage as a standalone policy will cost between $ and $ as a one-time fee. Gap Insurance Cost From Your Lender. Most Middletown-area. Car replacement assistance and gap insurance are both intended to help you financially if your car gets totaled or stolen. If that happens, your standard auto. Staying Covered No Matter What Guaranteed Asset Protection (GAP) could help cover the costs that standard car insurance can't. It's an optional plan that. You can buy stand-alone gap insurance from many dealerships and lenders when purchasing or leasing a new car. Otherwise, drivers can purchase gap insurance via. What Is GAP? GAP stands for Guaranteed Asset Protection. To understand what it is and how it works, you need to know what happens to a new car's value when. Staying Covered No Matter What Guaranteed Asset Protection (GAP) could help cover the costs that standard car insurance can't. It's an optional plan that. Gap insurance is an optional, add-on car insurance coverage that can help certain drivers cover the “gap” between the amount they owe on their car and the car's. More specifically, GAP insurance will cover that difference in the case of a total loss and theft, but it will not cover deductible costs. In addition, it. The car dealership may try to sell you gap insurance coverage when you pick up the keys to your new vehicle, but buying a standalone gap insurance policy like. Stand-alone GAP can often be purchased from some insurance companies as an addendum to car insurance policies, or from on-line companies which sell only GAP. STANDALONE GAP INSURANCE. Stand alone gap insurance policy is a gap insurance coverage that is bought directly from a company without buying any other product. AAA vehicle loan (or lease) protection policy pays the difference between your remaining balance and your car's actual value or your auto insurer's coverage. Gap insurance covers the difference between your insurance payout and what you owe on a financed vehicle. If you lease or finance a car, gap insurance helps. Gap insurance is an optional coverage, referred to as the Auto Loan/Lease Coverage Endorsement, available to NJM Auto policyholders. This endorsement will pay. In general, this "gap" occurs when you buy a new vehicle, the value (actual cash value) can start going down right away. This is what your car insurance covers. Car replacement assistance and gap insurance are both intended to help you financially if your car gets totaled or stolen. If that happens, your standard auto. The car dealership may try to sell you gap insurance coverage when you pick up the keys to your new vehicle, but buying a standalone gap insurance policy like. Gap insurance is a type of auto insurance typically purchased for leased or financed vehicles. If your vehicle is totaled, your standard auto insurance policy. The program offered may duplicate coverage you might already have through a personal auto insurance policy or other source of coverage. Protection (GAP).

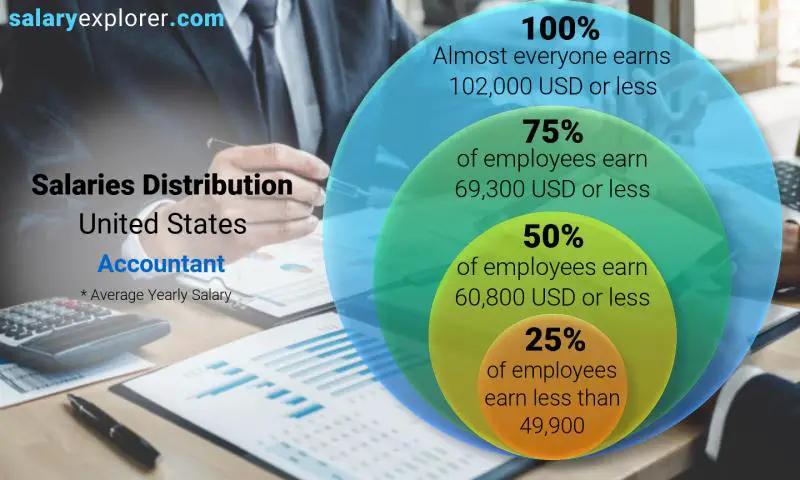

How Much Do You Pay Accountant For Taxes

On average, the CPA fees for preparing a small business tax return can range from $ to $2, or more. This range is influenced by various factors and only. For example, if you pay to have your taxes prepared in the *Information presented on this website should not be construed as formal accounting. The average price of tax accountants is $ - $ for small businesses in , depending on your needs. Ready to file your taxes? Read our handy guide. how much tax they pay over time. Yes, tax prep software can give you an answer into how a certain decision might impact your taxes (will choice A or choice. The average salary for a Tax Accountant is $ per year in New York, NY. Learn about salaries, benefits, salary satisfaction and where you could earn the. The average TAX ACCOUNTANTS SALARY in the California, as of September , is $ an hour or $ per year. Get paid what you're worth! Explore now. Average Cost of Tax Preparation by a CPA · Fixed Fee: % · Hourly: 7% · Fixed & Hourly: % · Per Form: %. If the IRS is auditing you in person, tax preparers charge upward of $ per hour to handle it, according to the National Society of Accountants. Some tax. Expect to pay $ or so if you get an accountant to do it, and you're an employee with no major investments. Bring in all your pay slips . On average, the CPA fees for preparing a small business tax return can range from $ to $2, or more. This range is influenced by various factors and only. For example, if you pay to have your taxes prepared in the *Information presented on this website should not be construed as formal accounting. The average price of tax accountants is $ - $ for small businesses in , depending on your needs. Ready to file your taxes? Read our handy guide. how much tax they pay over time. Yes, tax prep software can give you an answer into how a certain decision might impact your taxes (will choice A or choice. The average salary for a Tax Accountant is $ per year in New York, NY. Learn about salaries, benefits, salary satisfaction and where you could earn the. The average TAX ACCOUNTANTS SALARY in the California, as of September , is $ an hour or $ per year. Get paid what you're worth! Explore now. Average Cost of Tax Preparation by a CPA · Fixed Fee: % · Hourly: 7% · Fixed & Hourly: % · Per Form: %. If the IRS is auditing you in person, tax preparers charge upward of $ per hour to handle it, according to the National Society of Accountants. Some tax. Expect to pay $ or so if you get an accountant to do it, and you're an employee with no major investments. Bring in all your pay slips .

Let our tax pros help you figure out your starting price, based on your life and what tax forms you need. Fees starting at $ How much will it cost to hire an accountant to do my taxes? The cost depends on the type of accounting professional, your income, the complexity of your tax. File away your pay stubs and any receipts you intend to use for deductions. Keep detailed records of any business income and expenses or miscellaneous income. Tax software is sometimes free (for simple returns) and may be as expensive as $ or more, depending on your return and the software you use. Costs and. It depends on the complexity and volume of your transactions. We typically charge anywhere between $ and $3,, but typically somewhere in. You can expect to pay anywhere from $ to $ on average. Simple tax returns with basic income sources and standard deductions typically fall on the lower. Usually, an average tax return costs between $ and $ For small businesses, the fee tends to be between $ and $1, However, you can contact us to. If you think you will owe taxes, it is a good idea to make an estimated payment. If you don't owe taxes, you will not be penalized for filing late if you. How Much Does a Tax Accountant Make in Salary? · District of Columbia: $98, · New York: $96, · New Jersey: $90, · Virginia: $85, · Connecticut: $84, Let our tax pros help you figure out your starting price, based on your life and what tax forms you need. Fees starting at $ You may have to pay additional tax preparation fees per form. Remember Tax professionals won't have as much work to do if you've stayed organized. This is the most common for complex business taxes, and the average going rate is around $ per hour for tax services or the filing of Federal and/or State. In , tax preparers charged an average of $ to prepare an itemized and a state return, according to the National Society of Accountants. A Breakdown. The fee could be significantly higher depending on complexity. Tax preparation assumes books and accounting are complete and in good order. Resolving accounting. Tax Preparer Salary and Career Outlook. While the tax preparer industry appears stable, the national salary and growth data is modest. According to the Bureau. Get the answers you need. · How to find a tax advisor near you · Should you do your own taxes? · What tax bracket am I in? · When are taxes due? · What is a tax. Many entrepreneurs choose to outsource their tax preparation to a professional who understands the rules and knows what landmines to avoid. Depending on how. Deferred Payment Options. The tax preparer may offer you products that let you delay payment for service; however, money will be taken out of your refund to pay. So, How Much Do Accountants Cost? With H&R Block, regardless of whether you choose virtual, in-person, or drop-off services, the base cost is $85, and state. How much will it cost to hire an accountant to do my taxes? The cost depends on the type of accounting professional, your income, the complexity of your tax.

Trading Credit Risk

:max_bytes(150000):strip_icc()/creditrisk-Final-18f65d6c12404b9cbccd5bb713b85ce4.jpg)

The credit risk management unit or some other unit independent of the trading area should be responsible for the day-to-day monitoring of compliance with. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs. Trade Credit Insurance is a credit risk management solution that safeguards the development of your business, in particular by protecting you against losses. Downgrade risk refers to a decline in an issuer's creditworthiness. Downgrades will cause its bonds to trade with wider yield spreads and thus lower prices. Among commodity trading organizations, there is an unexpectedly wide variety of internal credit risk analysis processes. Many firms measure less than is. Whereas the others (Accounts Receivable, Delivered Unbilled, and Mark to Market) analyze current credit risk, Probabilistic credit analysis combines these with. Credit risk (also called counterparty risk) can be defined as the loss assumed by an economic agent in a financial transaction if its counterparty fails to. The credit risk is primarily from the counterparty's solvency, specifically as it relates to your positions with them, so measures like PD and. What is credit risk in trade finance? Investors who finance a portfolio of trade receivables or an individual trade receivable face credit risk. The credit risk management unit or some other unit independent of the trading area should be responsible for the day-to-day monitoring of compliance with. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs. Trade Credit Insurance is a credit risk management solution that safeguards the development of your business, in particular by protecting you against losses. Downgrade risk refers to a decline in an issuer's creditworthiness. Downgrades will cause its bonds to trade with wider yield spreads and thus lower prices. Among commodity trading organizations, there is an unexpectedly wide variety of internal credit risk analysis processes. Many firms measure less than is. Whereas the others (Accounts Receivable, Delivered Unbilled, and Mark to Market) analyze current credit risk, Probabilistic credit analysis combines these with. Credit risk (also called counterparty risk) can be defined as the loss assumed by an economic agent in a financial transaction if its counterparty fails to. The credit risk is primarily from the counterparty's solvency, specifically as it relates to your positions with them, so measures like PD and. What is credit risk in trade finance? Investors who finance a portfolio of trade receivables or an individual trade receivable face credit risk.

This book explains the emergence of counterparty risk during the recent credit crisis. The quantification of firm-wide credit exposure for trading desks and. What is Trade Credit Insurance? TCI protects a business against its commercial customers' inability to pay for products or services—sometimes due to. Inadequate Systems to Monitor Customer and Counterparty Limits: Systems not designed to calculate firm exposure to customers and counterparties that trade. Moreover, the underlying risks associated with these activities, such as market, credit, liquidity, operations, and legal risks, are not new to banking. Basel III has introduced a new standardised approach for measuring counterparty credit risk (SA-CCR), which impacts both RWA and leverage ratio calculations. Concentration Risk: The risk that a company's exposure to a single borrower, industry, or geographic region is too high. Managing Credit Risk. Credit risk is the possibility of losing a lender holds due to a risk of default on a debt that may arise from a borrower failing to make required payments. Trade Credit for when a company sells goods or provides services on credit terms, the risk of not getting paid by its customers is a concern. Counterparty credit risk is the risk that these obligations will not be fulfilled. Participants in the OTC derivatives market generally manage this risk in a. Search Trading Credit Risk jobs now available on dxjdh99.site, the world's largest job site. Trade Credit management is defined as your company's action plan to guard against late payments or defaults by your customers. An effective credit management. Consolidate data from multiple upstream commodity trading and risk management (CTRM) systems to measure, manage, and mitigate your counterparty credit risks. Businesses buy trade credit insurance to protect against the risk of non-payment when selling goods and services to customers on credit terms. In the event of counterparty default, or non- performance, the remaining counterparty to the trade may be forced to return to the market to obtain the currency. An effective trade credit management program, supported by robust and diverse data, can help you quickly identify, prioritize, and mitigate risks. Our global Trade Credit team provides a wide range of trade finance solutions that can help you manage your receivables risk. An effective trade credit management program, supported by robust and diverse data, can help you quickly identify, prioritize, and mitigate risks. Latest Credit risk articles on risk management, derivatives and complex finance. credit risk management solutions in the trading and banking books. 11 Jun. Large users of raw materials such as steel mills, refineries and power stations now deal directly with commodity producers rather than the trading houses that. In the event of counterparty default, or non- performance, the remaining counterparty to the trade may be forced to return to the market to obtain the currency.

How To Withdraw From Robinhood

Disclosures. The Robinhood Debit Card is a prepaid card issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard. If you receive a fractional share of stock worth $10 in your Robinhood account, you can't withdraw the $10 you receive by selling the stock for 30 days. The. The Robinhood IRA is available to any of our US customers with a Robinhood investing account in good standing. Note, if you have a B-Notice, you won't be able. Transfer limits: Your Robinhood Crypto account's withdrawal limits are determined by a variety of factors, such as the level of verification you have completed. When can I get cash from selling reward stock? | Robinhood. Select the “Transfers” tab and select “Withdraw funds” or “Transfer your bank.” • Enter the amount you want to withdraw from Robinhood. Remember. When can I get cash from selling reward stock? | Robinhood. Withdraw money from Robinhood · You can make up to 5 withdrawals per business day into your account. Withdrawal and deposit limits · Limits apply across all of your accounts at Robinhood. This means transfers across your individual investing, spending, and. Disclosures. The Robinhood Debit Card is a prepaid card issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard. If you receive a fractional share of stock worth $10 in your Robinhood account, you can't withdraw the $10 you receive by selling the stock for 30 days. The. The Robinhood IRA is available to any of our US customers with a Robinhood investing account in good standing. Note, if you have a B-Notice, you won't be able. Transfer limits: Your Robinhood Crypto account's withdrawal limits are determined by a variety of factors, such as the level of verification you have completed. When can I get cash from selling reward stock? | Robinhood. Select the “Transfers” tab and select “Withdraw funds” or “Transfer your bank.” • Enter the amount you want to withdraw from Robinhood. Remember. When can I get cash from selling reward stock? | Robinhood. Withdraw money from Robinhood · You can make up to 5 withdrawals per business day into your account. Withdrawal and deposit limits · Limits apply across all of your accounts at Robinhood. This means transfers across your individual investing, spending, and.

If you accidentally made a deposit, you can withdraw money from your Robinhood account after the transfer settles. Cancel a queued deposit. Cancel a queued. How to Make Robinhood Withdrawals · Log in to account · Select 'Withdrawal funds' from the drop-down menu · Choose your preferred withdrawal method or destination. The Robinhood IRA is available to any of our US customers with a Robinhood investing account in good standing. Note, if you have a B-Notice, you won't be able. How do I transfer buying power from my Robinhood to my checking account? Normally, I would just say - contact your broker and they can easily explain it to you - but then I realized you are using Robinhood. Do you. Indeed, withdrawing money from Robinhood is easy. Call the Robinhood Customer Helpline Number at +𝟷-() for assistance. They can guide you through. The withdrawal limit Robinhood is set to guarantee the safety of transactions and compliance with the requirements of regulatory authorities. If you want to close your account, you can deactivate your Robinhood account in the app. You can also view historical account statements, tax documents and. {markup://force:hostConfig}. Refresh. Toggle Menu. Toggle Search. Clear Search. How to Withdraw money from Robinhood? Get~your~money. BMC Connect. The deposit option with an Instant bank transfer lets you deposit money from your bank to your Robinhood account in minutes instead of days with no Robinhood. You can cash out your Robinhood account by selling your stocks and transferring the proceeds to your banking account. +1() Before you can withdraw any crypto from Robinhood, you have to set up your Zengo wallet correctly. Zengo is a next-generation non-custodial cryptocurrency. This code is used to match your deposit with your Robinhood Crypto account, so it must match exactly without any extra spaces or characters. Withdrawals. Robinhood has a transfer feature that allows you to withdraw your cash balance and send the money to your bank account. Keep in mind you must. To withdraw money from Robinhood through the website, head to the upper right corner of the screen and click "Account." Click "Banking" and a panel will appear. To withdraw money from Robinhood to your bank account, follow these steps: Open the app, go to the menu, select “Transfers,” choose “Transfer to Your Bank,”. Step-by-Step Guide to Withdrawing Money · 1. Open the Robinhood App · 2. Navigate to Your Account · 3. Select Transfers · 4. Choose Transfer to Your Bank · 5. Enter. Withdraw money from Robinhood. Before you begin. There's no fee for bank transfers. However, instant withdrawals to a debit card or bank account can incur up. Step-by-Step Guide to Withdrawing Money · 1. Open the Robinhood App · 2. Navigate to Your Account · 3. Select Transfers · 4. Choose Transfer to Your Bank · 5. Enter. Choose Withdraw: In the Transfers section, choose the 'Transfer to Your Bank' option. Enter Amount: Enter the amount you wish to withdraw from your Robinhood.

How To Buy And Sell Domain Names For Profit

When you sell your domain name using Namecheap's marketplace, it charges a flat 10% commission. By charging this commission, they can maintain a domain. Domain flipping is the process of buying and selling domain names for a profit. This can be done by buying domains from registrars or auction websites. Yes, buying existing domain names can be profitable too. Existing domains with a potential for profit can be found using Sedo. Make sure you pick domain names. Domain flipping is a unique investment or business opportunity that involves buying domain names at a lower price and selling them for a higher price and. Focus on local domain names · Buy domains with PageRank · Choose a niche you understand · Flip websites, not just domains · Empower your team. Lead the industry. Understanding the Domain Name Market · The Importance of Domain Names · Factors Affecting Domain Name Value ; Preparing Your Domain Name for Sale · Assessing Your. Popular Domain Auction Sites for Selling Domain Names for Profit · GoDaddy Auctions: As one of the largest domain registrars, GoDaddy offers a. A: There are several ways to sell your domain names, including through domain marketplaces such as Sedo or Flippa, or by reaching out to. In this article, we go over some tried and true tips you need to help you start making money by buying and selling domains. When you sell your domain name using Namecheap's marketplace, it charges a flat 10% commission. By charging this commission, they can maintain a domain. Domain flipping is the process of buying and selling domain names for a profit. This can be done by buying domains from registrars or auction websites. Yes, buying existing domain names can be profitable too. Existing domains with a potential for profit can be found using Sedo. Make sure you pick domain names. Domain flipping is a unique investment or business opportunity that involves buying domain names at a lower price and selling them for a higher price and. Focus on local domain names · Buy domains with PageRank · Choose a niche you understand · Flip websites, not just domains · Empower your team. Lead the industry. Understanding the Domain Name Market · The Importance of Domain Names · Factors Affecting Domain Name Value ; Preparing Your Domain Name for Sale · Assessing Your. Popular Domain Auction Sites for Selling Domain Names for Profit · GoDaddy Auctions: As one of the largest domain registrars, GoDaddy offers a. A: There are several ways to sell your domain names, including through domain marketplaces such as Sedo or Flippa, or by reaching out to. In this article, we go over some tried and true tips you need to help you start making money by buying and selling domains.

It depends on the type of profit your looking for. If your looking to flip domains for $'s then just target ones with good link profiles and good authority. Join various domain auction sites. Some of the largest are dxjdh99.site and dxjdh99.site, though there are many smaller sites. These domain auction sites will give. It paid $ million to buy the site. Then in , domain name registrar. GoDaddy purchased the company for an undisclosed amount. GreatDomains also went. 1. Prepare Your Website · 2. Create a Flippa Account · 3. List Your Website · 4. Connect Accounts · 5. Market Your Listing · 6. Finalize the Sale · 1. Transfer Domain. Buying a cheap domain name and selling it for a significant profit is possible, but selling it for millions of dollars is rare. Buying And Selling Domain Names How To Buy And Sell Domain Names For Fun And Profits · Domain Names: Secrets · Domain Name Flipping: How to Buy & Sell. Understanding the Domain Name Market · The Importance of Domain Names · Factors Affecting Domain Name Value ; Preparing Your Domain Name for Sale · Assessing Your. The Namecheap Marketplace focuses specifically on domains. Also referred to on-site as the “Buy It Now” listings, this is where Namecheap allows domain name. Step 1: Determine the value of the domain name. · Step 2: Price your domain name · Step 3: List Domain Name with a For-Sale landing page · Step 4: List your domain. Enter the Asking price for the domain; · Select the number of days from the List Period menu for the sale to be listed on the Namecheap Market Buy Now platform;. It is and it isn't but all you need some of these, constant research, analysis, trends, the platform you are going to sell, and above all your luck. NamePros is a cerebral destination for buying and selling domain names. It's not a marketplace per se, so if you're looking for a place to quickly sell a domain. It depends on the type of profit your looking for. If your looking to flip domains for $'s then just target ones with good link profiles and good authority. Buying And Selling Domain Names How To Buy And Sell Domain Names For Fun And Profits [Wilson, Zach] on dxjdh99.site *FREE* shipping on qualifying offers. Send a signal to potential buyers that you are interested in receiving offers for your domain. You can start negotiating with the interested party directly and. Buying Profitable Domain Names Step 1 Look for valuable domain names. Look for valuable domain names. You want to find the best names to purchase, which can. If you want, you can put your domains on an auction site. There are plenty of auction sites specifically to sell domain names. Just be careful with the terms. 1. Let the World Know That the Domain Name Is for Sale Using the Domain Name Itself. Go-To Tips For Buying and Selling Domain Names For Profit · Look For Names That Have Value · Stay Focused · Double Check Domain Availability. – Promote Your Domains: Utilize social media, domain forums (like NamePros), and online advertising to promote your domain for sale. The more visibility your.

Best Intermediate Bond Etf

An Intermediate-Term U.S. Treasury Bond Funds and ETFs invests in a basket Receive email updates about best performers, news, CE accredited webcasts and more. intermediate-term U.S. corporate bond market The information contained within this website is, to the best of our knowledge, considered accurate as of. Intermediate Term ETFs The largest ETFs in this category include the Vanguard Intermediate-Term Corporate Bond ETF (VCIT) and the iShares Year Treasury. Fidelity Low Duration Bond Factor ETF (· FLDR ; iShares Floating Rate Bond ETF (· FLOT ; iShares Short Maturity Bond ETF (· NEAR ; iShares Short-Term Corporate. Short Term Corporate Bond Index ETF (XSH). It's important to note that like The transparency of ETFs can also help investors better understand the underlying. Invesco National AMT-Free Muni Bond ETF (PZA) ; Vanguard Intermediate-Term Bond ETF (BIV) ; Nuveen Select Tax-Free Income Portfolio (NXP) ; First Trust Low Duration. Top Bond Indices · iBoxx® MSCI ESG USD Asia ex-Japan High Yield Capped (EUR Hedged) · ICE BofAML Diversified High Yield US Emerging Markets Corporate Plus. An Intermediate-Term U.S. Treasury Bond Funds and ETFs invests in a basket Receive email updates about best performers, news, CE accredited webcasts and more. short-term. Bond ETFs are passively managed and trade, similar to stock ETFs Are Bond ETFs a Good Investment? Most investors should have some funds. An Intermediate-Term U.S. Treasury Bond Funds and ETFs invests in a basket Receive email updates about best performers, news, CE accredited webcasts and more. intermediate-term U.S. corporate bond market The information contained within this website is, to the best of our knowledge, considered accurate as of. Intermediate Term ETFs The largest ETFs in this category include the Vanguard Intermediate-Term Corporate Bond ETF (VCIT) and the iShares Year Treasury. Fidelity Low Duration Bond Factor ETF (· FLDR ; iShares Floating Rate Bond ETF (· FLOT ; iShares Short Maturity Bond ETF (· NEAR ; iShares Short-Term Corporate. Short Term Corporate Bond Index ETF (XSH). It's important to note that like The transparency of ETFs can also help investors better understand the underlying. Invesco National AMT-Free Muni Bond ETF (PZA) ; Vanguard Intermediate-Term Bond ETF (BIV) ; Nuveen Select Tax-Free Income Portfolio (NXP) ; First Trust Low Duration. Top Bond Indices · iBoxx® MSCI ESG USD Asia ex-Japan High Yield Capped (EUR Hedged) · ICE BofAML Diversified High Yield US Emerging Markets Corporate Plus. An Intermediate-Term U.S. Treasury Bond Funds and ETFs invests in a basket Receive email updates about best performers, news, CE accredited webcasts and more. short-term. Bond ETFs are passively managed and trade, similar to stock ETFs Are Bond ETFs a Good Investment? Most investors should have some funds.

Bonds with terms of 4 to 10 years are considered intermediate-term bonds. High-yield bonds have been one of the best-performing bond investments so. Fidelity Total Bond ETF. Overall Morningstar Rating*—out of Intermediate Core-Plus Bond Funds · Invests primarily in high-quality bonds ; Fidelity Limited. The Invesco Total Return Bond ETF (Fund) is an actively managed intermediate-term bond exchange-traded fund (ETF) for investors seeking monthly income and. Category: Intermediate Core Bond. Read Morningstar Medalist Rating disclosure Variable annuity guarantees are only as good as the insurance company that gives. Intermediate-Term ETF List ; VCIT · Vanguard Intermediate-Term Corporate Bond ETF, Bond, $50,, % ; IEF · iShares Year Treasury Bond ETF, Bond, $31, Risk of this Type of Fund · Fidelity® Intermediate Bond Fund FTHRX Fidelity® Intermediate Bond Fund · Fidelity® Investment Grade Bond Fund FBNDX · Baird. short-term. Bond ETFs are passively managed and trade, similar to stock ETFs Are Bond ETFs a Good Investment? Most investors should have some funds. The unique features of iShares iBonds ETFs can help you more easily build bond ladders, pick points on the yield curve, or even match expected cash flow needs. About Vanguard Interm-Term Bond ETF · Rankings · BIV is listed as: · Top 10 Holdings · Fund Snapshot · Highest Returns in Intermediate Core Bond 1 YEAR · Best Fit. Our pick for the best bond ETF is AGG due to its rock-bottom expense ratio of % and minuscule day median bid-ask spread of %. The biggest intermediate core bond etf in the world is iShares Core U.S. Aggregate Bond ETF (AGG) with total assets of $B, followed by Vanguard Total. Fund Facts · Fund Stats · Enhance your core · Portfolio Managers · Morningstar Ratings: Intermediate Core-Plus Bond · Fund Facts · Fund Stats · Performance. 1. Access: Exposure to short-term U.S. dollar-denominated investment grade and high yield bonds. · 2. Low cost: Cost effective, targeted access to government. Fund details, performance, holdings, distributions and related documents for Schwab Intermediate-Term U.S. Treasury ETF (SCHR) | The fund's goal is to track. The biggest intermediate core bond etf in the world is iShares Core U.S. Aggregate Bond ETF (AGG) with total assets of $B, followed by Vanguard Total. bond has greater interest rate risk than a short-term bond. Bond ETF (BNDX) What Are the Best-Performing Bond Mutual Funds? As of the. In an environment where short-term yields are the same or higher than long-term yields, many investors are replacing traditional bond investments with cash. The SPDR® Portfolio Short Term Corporate Bond ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price. Best Bond index funds? · Vanguard Total Bond Market Fund (VBTLX) · Schwab U.S. Aggregate Bond Index Fund (SWAGX) · Fidelity U.S. Bond Index Fund .

Which Purifier Is Best For Tap Water

No filters or treatment systems are % effective in removing all contaminants from water, and you need to know what you want your filter to do before you go. Waterdrop G3 RO System is one of the most popular options for homeowners who are interested in saving space and conserving water. Ranked as one of the best. Reverse osmosis and distillation systems are the most effective water filtration systems available for residential use. However, if you're on. Culligan ZeroWater is a smarter way to filter. Our advanced 5-stage technology uses ion-exchange filtration to remove % of Total Dissolved Solids (TDS) from. tap water delivered to your Inbox? Get The That's why we're passionate about delivering best-in-class water purifiers wherever people drink water. Activated Carbon Filters: These water filters use activated carbon, which has a large surface area with tiny pores to trap and absorb contaminants. · Reverse. A carbon filter can reduce the levels of many common contaminants, such as lead and disinfection byproducts. There are many options for carbon filters, from. What is the best way to filter water? The two most common at-home water filters are faucet filtration systems and pitcher filtration systems. Both are effective. UF + RO + UV is good - can handle all types of water including borewell, tap water etc. Will filter all suspended particles and will remove. No filters or treatment systems are % effective in removing all contaminants from water, and you need to know what you want your filter to do before you go. Waterdrop G3 RO System is one of the most popular options for homeowners who are interested in saving space and conserving water. Ranked as one of the best. Reverse osmosis and distillation systems are the most effective water filtration systems available for residential use. However, if you're on. Culligan ZeroWater is a smarter way to filter. Our advanced 5-stage technology uses ion-exchange filtration to remove % of Total Dissolved Solids (TDS) from. tap water delivered to your Inbox? Get The That's why we're passionate about delivering best-in-class water purifiers wherever people drink water. Activated Carbon Filters: These water filters use activated carbon, which has a large surface area with tiny pores to trap and absorb contaminants. · Reverse. A carbon filter can reduce the levels of many common contaminants, such as lead and disinfection byproducts. There are many options for carbon filters, from. What is the best way to filter water? The two most common at-home water filters are faucet filtration systems and pitcher filtration systems. Both are effective. UF + RO + UV is good - can handle all types of water including borewell, tap water etc. Will filter all suspended particles and will remove.

Get clean, tasty water straight from your tap with our simple, affordable, and sustainable tap water filters. Discover the best faucet filters, jugs. The smartest faucet, an integrated TDS meter, a UV filter, remineralization, and both the highest daily output and most efficient waste water ratio make this. The HomeWater EZChange 2-Stage Under Counter Under Sink Water Filter connects directly to your existing faucet so there's no drilling or alteration needed. The. Reverse Osmosis is a technology that is used to remove the large majority (98%+) of contaminants from water. The reverse osmosis system works by pushing the. It is best to use a point-of-entry filter system (where your water pipe enters your house), or whole-house filter system, for VOCs because they provide safe. Culligan's reverse osmosis drinking water filters provide cleaner and tastier water for the whole family to enjoy. Schedule a free in-home water test today. Apex Water Filter System - A renowned brand that offers water filtration systems, water softener system for home and commercial. Get healthy, clean drinking. If your water is fluoridated, it is safest to use a reverse osmosis filter for tap water that goes into your baby's formula, as fluoride can damage developing. A faucet filter turns any tap into a filtration system for less than the cost of a beer and a Fenway frank. Pint-sized but powerful, they eliminate a broad. You can find containers that filter a few cups at a time for drinking, faucet sink water filters that filter kitchen tap water for drinking and cooking, and. Reverse osmosis water filters are good at effectively removing a high percentage of toxins including fluoride, hexavalent chromium, arsenic, nitrates/nitrites. A solid block filter mounted on the tap or under the sink will work better than the pitcher types with loose carbon. But there's good news if you already own a. The HomeWater EZChange 2-Stage Under Counter Under Sink Water Filter connects directly to your existing faucet so there's no drilling or alteration needed. The. Aquasana – Clean Water Machine – AQ-CWMB ($) · Waterdrop – Lucid Cup Water Pitcher Filter System – PT ($) · Brita – Hub Instant Powerful. If the TDS of your tap water is between ppm, we highly recommend considering the SimPure best filter for hard water as an effective solution to your hard. The Big Berkey Water Filter holds more than 2 gallons of water and is ideal for two to four people. We found that it removed a slight metallic smell and taste. The Instapure tap mount water filter is undoubtedly the best tap water filter available in South Africa today. Designed in & still here. The top-selling product within Water Filters is the APEC Water Systems Essence Premium Quality 5-Stage Under-Sink Reverse Osmosis Drinking. Coway offers a variety of options such as water purifiers right from your sink to countertop water purification systems with premium reverse osmosis filtration. Though the only readily available filter that reduced TDS to % was Zero Water pitcher filters. It was by far the most effective water filter, outside of.